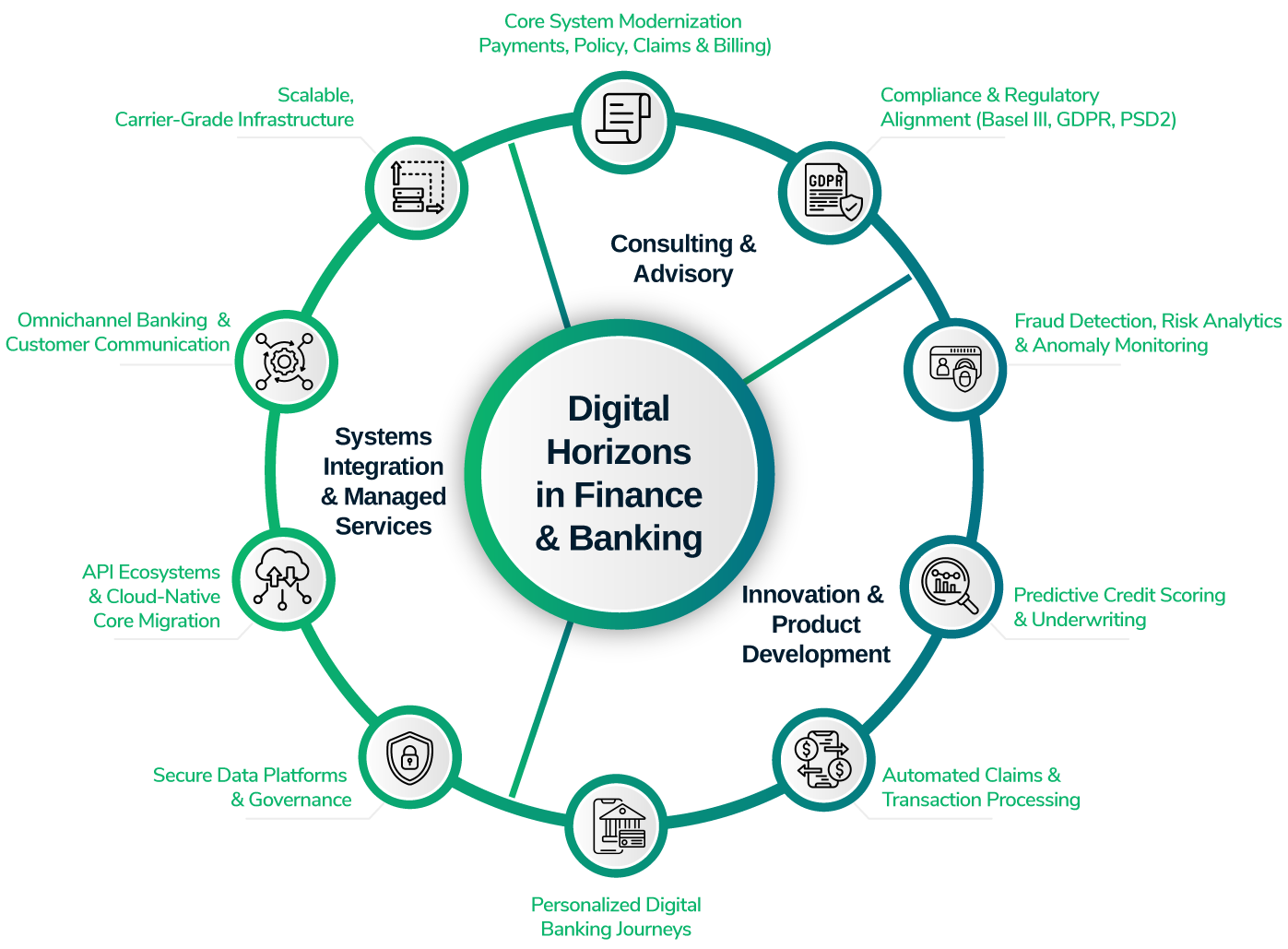

Building scalable, intelligent foundations for the future of finance

Odine helps financial institutions design secure, scalable, and intelligent infrastructure solutions to meet the ever-evolving demands of modern banking. With deep expertise in regulated and high-availability environments, we address the industry’s top priorities through adaptable, AI-powered, and integration-ready technologies. Our capabilities further enable customer attrition modeling and predictive retention strategies, along with AI-driven support solutions that lower call center costs and elevate client experience.

- Modernized and unified system architectures that enable agility and efficiency

- Strong alignment with regulatory requirements and secure data governance practices

- Real-time analytics capabilities that drive predictive, insight-led decision-making

- Consistent high availability across both physical branches and digital platforms

- Scalable, audit-ready digital transformation strategies that meet evolving business demands

- Data-driven insights supporting customer retention initiatives

- Virtual assistants and chatbots improving service quality and reducing operational overhead

Driving digital transformation in Finance

Odine enables financial institutions to evolve their infrastructures with agility, security, and intelligence. By unifying core-to-edge architectures, embedding compliance into every process, and leveraging AI for anomaly detection and performance monitoring, we support modernization while ensuring resilience and trust in a digital-first economy. Our AI and automation capabilities can underpin predictive retention analytics, attrition risk modeling, and AI-powered engagement platforms that help financial intitutions and banks to manage customer loyalty while reducing service costs.

- Deep-rooted engineering discipline shaped by mission-critical high-availability environments

- Certified professionals in virtualization, infrastructure security, and enterprise AI

- Flexible integration models that accommodate legacy modernization

- Access to a portfolio of finance-sector software solutions with strong industry references

Security & Compliance by Design

In banking, security isn’t an add-on, it’s the baseline. We embed multi-layered security, role-based access, and policy automation into every architecture. This approach is extended through Secure Access Service Edge (SASE) frameworks, enabling secure, cloud-delivered connectivity and consistent policy enforcement across branches, remote employees, and digital platforms.

Core-to-Edge Infrastructure Modernization

From physical branches to digital channels, we modernize banking infrastructure by implementing high-speed, fault-tolerant, and software-defined networks, supporting secure, uninterrupted customer experiences and consistent service quality that fosters loyalty.

Virtualization & Data Center Engineering

We design and integrate virtualized environments that optimize storage, accelerate critical workloads, and enable hybrid operations. These setups provide the technical foundation for advanced analytics, including attrition prediction and retention-focused customer scoring.

AI-Augmented Risk & Performance Intelligence

Using synthetic or anonymized data, we demonstrate how AI can elevate banking operations, enhancing fraud detection, transaction anomaly monitoring, customer scoring, and proactive system health diagnostics. These capabilities can extend to predictive retention strategies and AI-powered virtual assistants, enabling cost-efficient service models and stronger customer relationships.

Explore

Logate’s portfolio with Odine

Powered by Odine

- Learn more

Specialized Banking CRM