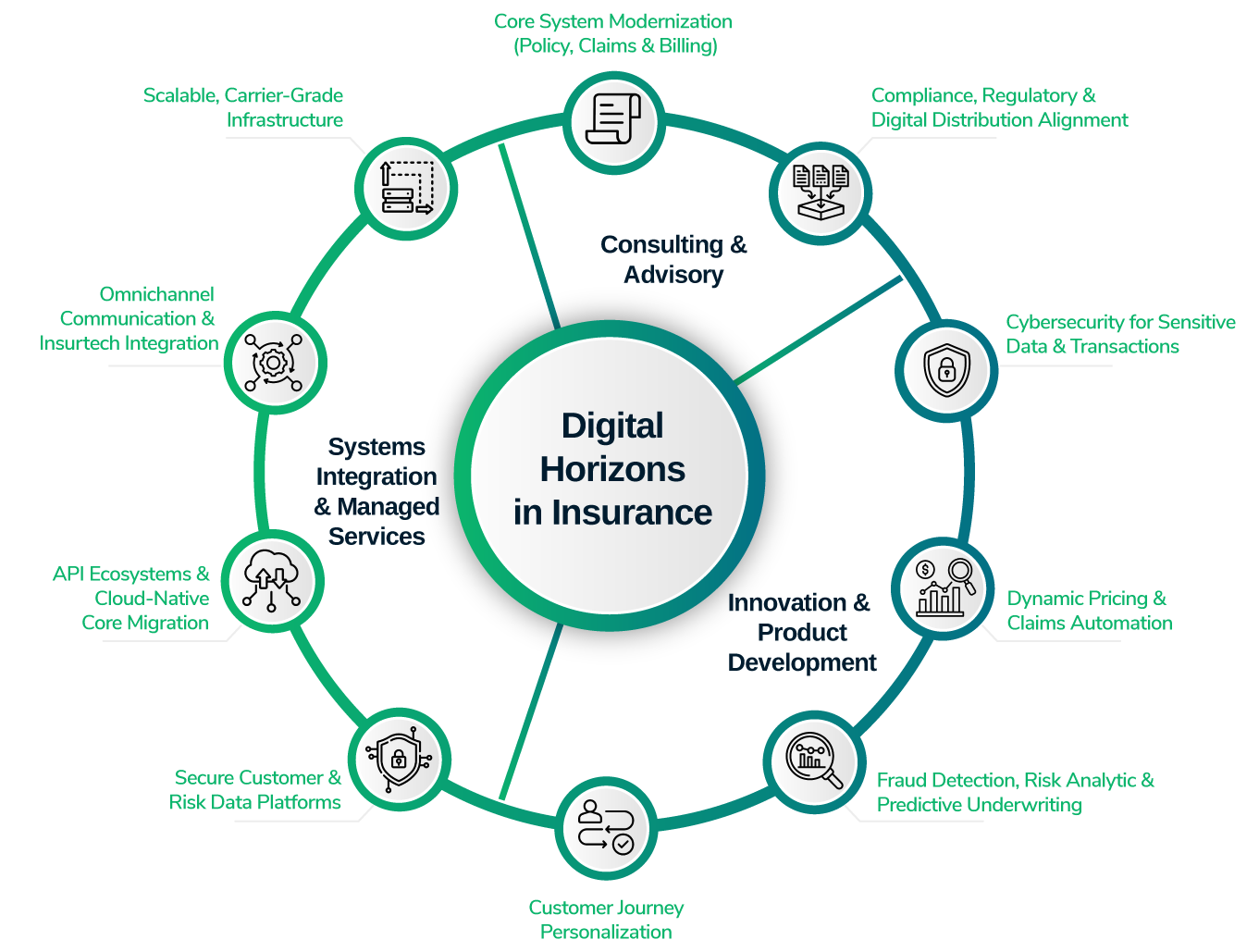

Empowering secure, AI-powered transformation to elevate risk management and customer experience

Odine supports insurers in adopting intelligent, resilient, and highly secure digital infrastructure to improve risk management, streamline operations, and deliver seamless customer experiences.Our AI-driven platforms integrate data, automation, and analytics, creating the foundation for advanced capabilities such as predictive churn analysis, improved retention strategies, and AI-powered chatbots that can reduce call center costs while enhancing service quality.

- Modernizable system infrastructures and unified data ecosystems

- Expanding opportunities for digital customer engagement

- Advanced analytics supporting risk, fraud, and retention-focused use cases

- Optimized operational alignment across brokers, agents, and carriers

- AI-powered chatbot and automation scenarios driving cost efficiency

Driving digital transformation in Insurance

Odine empowers insurers to modernize core systems, integrate insurtech innovation, and unlock new digital distribution models. Through scalable platforms and AI-driven solutions, we enable precise risk prediction, faster claims automation, and personalized customer journeys, while making it possible to support churn analysis, strengthen retention, and unlock operational savings through intelligent automation.

- Deep expertise in large-scale infrastructure transformation

- Comprehensive observability and intelligent network routing

- Integration-ready systems designed for minimal operational overhead

- Flexible, modular deployment adaptable to diverse organizational needs

AI-Powered Risk, Fraud & Retention Analytics

We provide anomaly detection and machine learning models to detect fraudulent patterns, assess risk profiles, and automate claims triage. These same capabilities can be extended to support predictive churn analysis and customer retention improvements, giving insurers the flexibility to address loyalty challenges with data-driven strategies.

Omnichannel Communications Infrastructure

Odine designs and implements secure, seamless, and scalable multi-channel network infrastructures that support interactions between insurers, agents, and brokers. Enhanced with AI-powered chatbot capabilities, these platforms can help reduce call center costs while improving responsiveness and customer satisfaction.

Predictive Operations

We enable early detection of operational bottlenecks and resource risks using AI-driven telemetry and workflow observability tools, capabilities that can also support efforts to reduce churn and enhance retention through better decision-making.

Application Modernization

Odine helps insurers replace legacy systems, outdated databases, and manual business processes with microservices-based, cloud-enabled applications. This transformation reduces complexity, improves agility, and ensures that insurers can innovate faster, scale seamlessly, and meet evolving regulatory and customer expectations.