How can we sustain and increase margins? The question on every CFO’s mind.

For the international voice business, maintaining margins has been a priority for many who for years were on a revenue model. This is more challenging under the current legacy network model. Everywhere you look – from manual Excel cost sheets to invoice generation – there are inefficiencies and a lack of automation that are costly, making it difficult to drive savings.

For a long period of time, pressure on voice margins have led to a change in business focus. Organizations have accepted that profits will fall as a standard. This article instead looks at how operators, even in the face of market decline, can create competitive sustainability.

The current model needs a new point of focus

The current wholesale model makes it almost impossible to generate any new revenue, making the CFO’s role increasingly difficult.

Firstly, investment vastly outweighs profit.

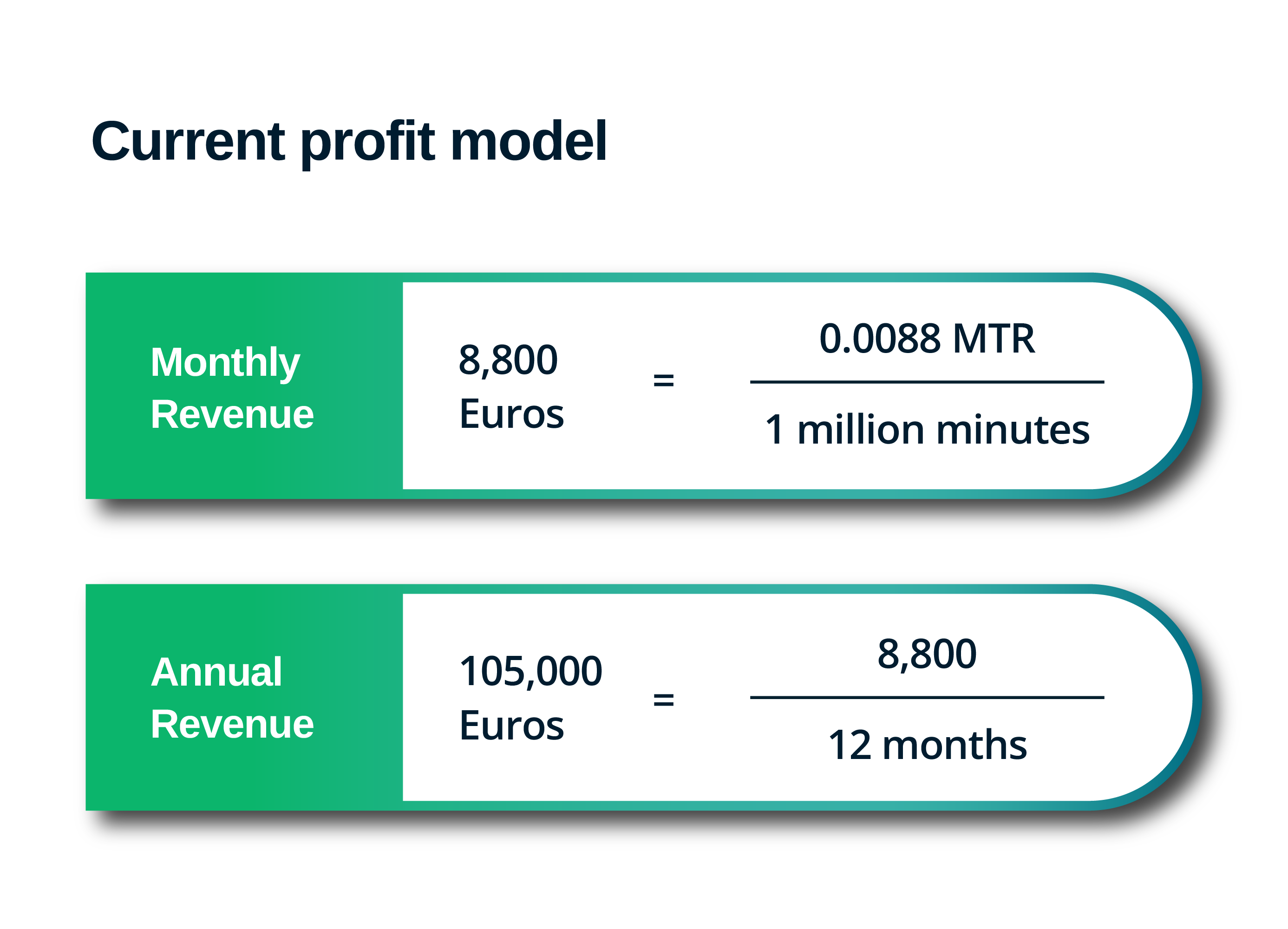

Generally, wholesale voice is traded in cents while hundreds of thousands of dollars are spent on infrastructure and operational costs annually. According to Digital Regulation Platform, the average MTR for minutes for example is decreasing in value across the globe, dropping from 0.14 Euros in 2004 to 0.0088 in 2019 – a 93% decrease in return – with other regions such as India demonstrating even more dramatic declines. When it comes to profit, the totals are lackluster.

This is happening for various reasons, including fiercer competition, an increase in fraud risk, changes in customer demand and a race to the bottom mentality. The bigger issue is that even as the revenue gained from minutes decreases, the cost it takes to service the network doesn’t change, resulting in increasingly slimmer margins.

Secondly, increasing traffic significantly under these circumstances is unachievable.

To make margin on minutes, for example, organizations would need to increase by hundreds of millions of minutes, a difficult pursuit in itself without the added challenge of market competition.

The years of CAPEX investment in networks and equipment have passed, and with pressure on margin, the view from the CFO’s chair must be that we can’t run a service which is financially challenging.

So, it’s time to adapt: if you are unable to drive margin up, then drive the cost of service down. Understand exactly what every minute costs – so you know the relationship between minutes and margins.

Margin Leakage

You have heard of revenue leakage but what happens when you are unwittingly being overcharged? Are you comfortable that you know the Origin Based Charging rules relating to every destination you are carrying, and are you paying the correct rate?

There are huge differences in calling costs and it’s likely some of, or all, your traffic is exempt from OBR surcharges. If you don’t know and aren’t aware, it’s more than likely your supplier is charging you a higher rate. This could be as much as $0.30 more per minute depending on the destination. For example;

Surcharge rate per minute – $0.30 x 1M minutes = $300,000

Non-Surcharge rate – $0.05 x 1M minutes = $50,000

That’s a $250,000 overcharge if you are not managing OBR correctly.

OBR fines being handed out by regulators are another concern, with some countries seeing significant increases in fines to stop fraud and mishandling of calls.

Finally, reinvestment becomes impossible to justify.

How do you continue to keep up with scam and spam regulations without renewing your systems investment or continuing to add resource? Especially when we consider the risks associated with new fraud techniques and pricing mechanisms, such as Origin Based Pricing.

CFOs realize that not only are voice services financially challenging, they need reinvestment to minimize risk and to remain compliant.

There’s a better way to maximize profit

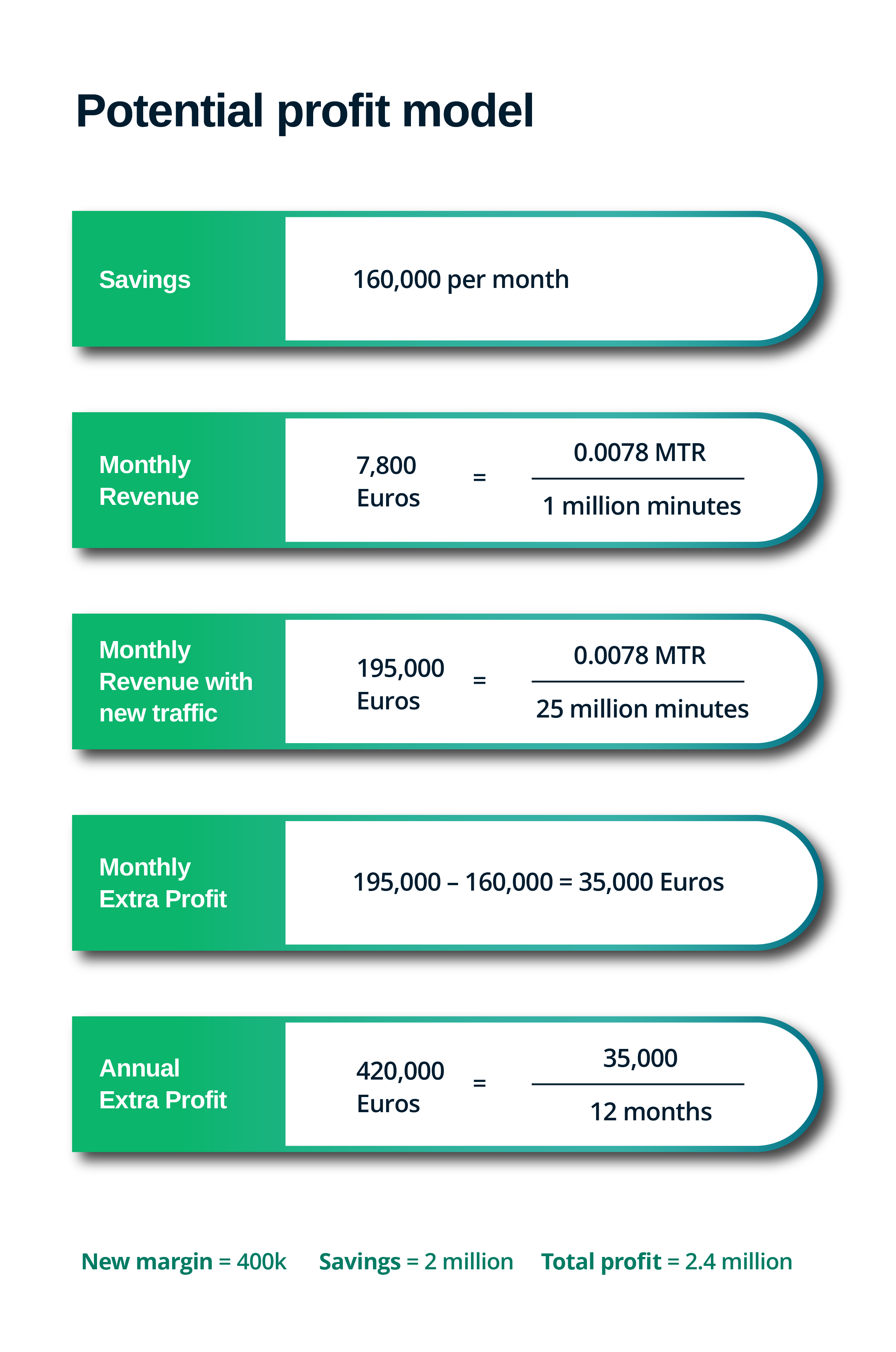

Odine delivers network transformation which, based on real customer data, has the potential to save operators upwards of $3m annually, whilst also enhancing the service provided to customers. So, can you really offer more for less? The answer is yes.

This would allow organizations to lower their termination costs and attract new traffic with a more competitive price offer. This can be a game changer for operators looking to maintain a competitive advantage and create a sustainable model for 2023 and beyond.

Read Part 2 to see where operators should focus their efforts in order to maximize cost savings.